There are several different types of interest that you can deduct on your tax return. You can deduct interest that is an ordinary and necessary expense related to your trade or business; interest on the debt-financed acquisition of ownership in a partnership or S-corporation; interest related to your personal investments; interest on student loans; and interest paid as qualified home mortgage interest. Where the interest is reported on your return depends on how the borrowed funds are used. Here are five types of interest that can be deducted on your tax return.

Cash can generally be found in one of three ways: you earn it, you receive it as a gift, or you borrow it. The bad part about earning income is paying income taxes. When you are gifted cash, you normally don’t have to do anything else with the tax-free money except decide on how to spend it (thank you, Grandma and Grandpa). But when you borrow money, you are going to have to pay the money back. With interest. Fortunately, there are instances where you can deduct the interest paid from your taxable income and pay less in taxes. This lowers the cost of borrowing and might change your decision on borrowing.

Ordinary and Necessary Business Interest – When financing the operational costs or expansion costs for your business, you can deduct the interest component of paying off the debt. So, a car purchased with a loan in the name of the business for business purposes would have the interest payments be fully deductible. The interest payments on a personal vehicle, however, will not be deductible. Cash borrowed to cover cash flow through a down season in the business is deductible, yet cash borrowed to finance Christmas shopping is not.

Debt-financed Acquisition Interest – If you took out a loan to buy ownership in a partnership or an S-corporation for which you will receive a K-1, then you can deduct the interest paid on the loan to directly reduce the taxable income from the business. The nature of your involvement in the business, such as active or passive, will characterize the type of expense related to the interest. If you are active in the business, then the interest deduction will be characterized as active; if you are passive in the business, then the deduction will be characterized as passive and the deduction could be limited to passive income. The interest will be deducted directly on the Schedule E along with your K1 from the business.

Student Loan Interest – Interest paid on qualified student loan debt is deductible if your modified AGI is below a certain level. To qualify, the debt must have come from a qualified educational institution for qualified expenses for you, your spouse, or your dependent, while attending at least halftime in a program leading to a certificate, degree, or credential. For single taxpayers, the deduction is phased out beginning at $65,000 of modified AGI and is non-deductible once modified AGI is over $80,000. For joint filers, the deduction is phased out beginning at a modified AGI of $135,000 and is fully phased-out at $165,000 modified AGI.

Investment Interest – Sometimes an opportunity comes along that is too good to pass up, but unfortunately, you do not have enough cash to fully invest. If you could just find an interest rate that is lower than your return on the investment, then it would make sense to borrow the money to invest. The Tax Cut and Jobs Act removed investment expenses as an itemized deduction, but the investment interest expense deduction survived. The deduction is reported on Schedule A, meaning that you must itemize to be able to receive the benefit of claiming the deduction. For 2018, the standard deduction for a single taxpayer is $12,000 and $24,000 if you are filing a joint return. If you can itemize, then deducting the interest payments might reduce your effective borrowing rate and make borrowing the funds a viable alternative in purchasing the investment.

Home Mortgage Interest – The type of deductible interest that most of us are familiar with is the home mortgage interest deduction. Again, this type of interest deduction is only for those who will be itemizing. Under the Tax Cuts and Jobs Act, the calculation of the deductible portion of home mortgage interest was changed. Under the new law, only interest on the first $750,000 of home acquisition indebtedness is deductible. Interest paid on home equity lines of credit used for personal expenses not related to the home is no longer deductible for tax years 2018 – 2025.

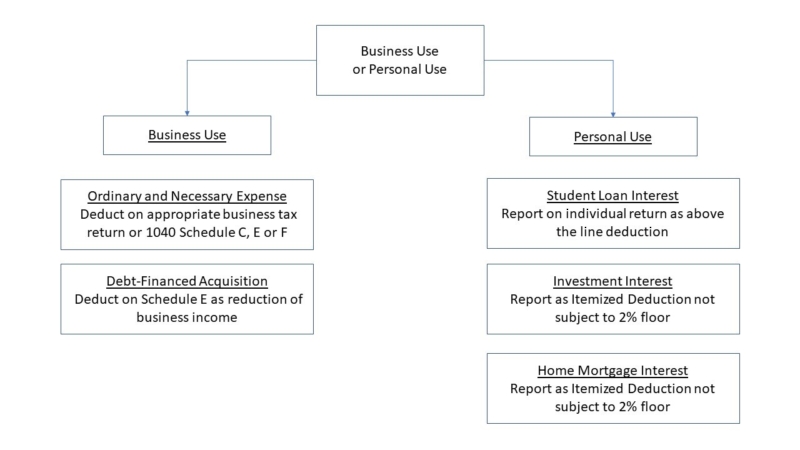

When deciding which types of interest you paid are deductible or not, determine first if the funds were used for a personal or a business expense. If the debt was used for a business expense, then you can deduct the interest on your business return or the appropriate Schedule C, E, or F on your personal return; and if you used the funds to purchase ownership in a business, then you can deduct the interest paid directly on the Schedule E. If the cash was used for a personal expense, then ask if the funds were used for paying interest on qualifying student loans. If they were, then report the allowable interest portion as an above the line deduction on your individual return. If the loan was not a student loan, was it used to buy a personal investment? If so, and you can itemize, then report the interest expense as an itemized deduction. Finally, if the interest paid does not fit into any of the categories above, was the interest paid on a loan for buying, building, or improving your home? If so, then report the interest as deductible home mortgage interest on your Schedule A. If the interest still does not fit into any of the categories mentioned, then odds are, it is not deductible.

Here is a chart to help visualize the types of interest and where to report the deduction:

Knowing if you will be able to deduct the interest paid on borrowed funds will be an important factor when deciding on whether to borrow, save, or ask relatives for an early inheritance the next time you need to finance a major purchase, expansion or investment. Your return on investment could change based upon being able to deduct the interest and what first looked like a losing bet could change into a new opportunity.

For more information on deducting interest and other potential deductions, contact Abacus CPAs at www.abacuscpas.com or call us at 417-823-7171. Better Guidance. Smarter Decisions.